So our previous Financial Fridays have covered the beginnings of our financial journey and the initial steps we took to change direction towards improving our fiscal health. However, you might be wondering just what does a budget actually look like. Is there a particular style or type that works better than others? Do you keep a budget on paper or an electronic file?

I can’t tell you what style or format is going to work best for you and your financial situation. I can only share what we have done and how it has worked for us. The same system might work for you but it might not and if it doesn’t, then keep searching to find one that does. The first thing to think about is whether or not you are a paper and pencil personality or enjoy working with spreadsheets like Excel? When we first started this journey, I was old school: paper, drawing grids with markers and a ruler, then filling in the information in pencil. I learned that trying to write all the things down in pen wasn’t the best way to go when creating my first few budget spreadsheets by hand. There was a LOT of scribbling out things and rewriting!

It took a little while before I became comfortable with spreadsheets in Excel and once I got the basics down, it has become my preferred method to use. Also, using formulas in the various cells to automatically calculate things is very helpful. Overall, I have found that an electronic budget is easier to adjust as things change. As you get some of those line items paid off and no longer have that particular debt, you’ll get the satisfaction of deleting a row for a bill you no longer have … like credit cards! Every time I deleted a row for Visa, MasterCard or Discover, it was like a weight lifted off my shoulders because I could immediately see how removing that monthly bill improved my bottom line (thanks to those handy formulas).

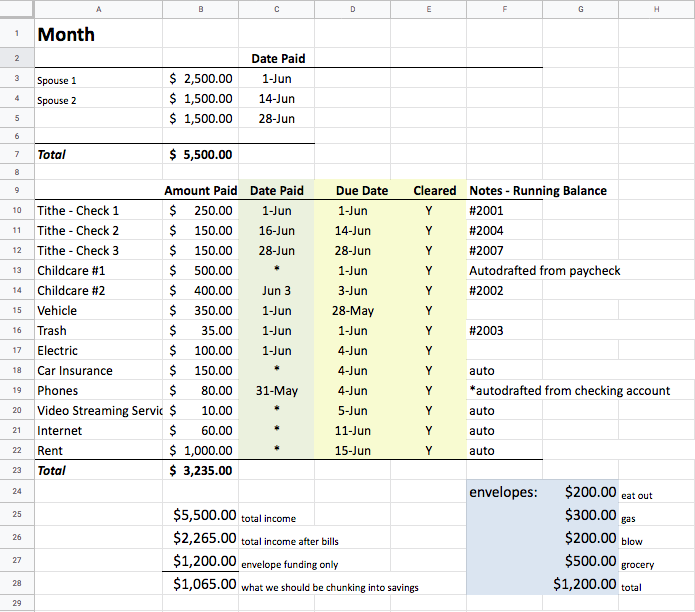

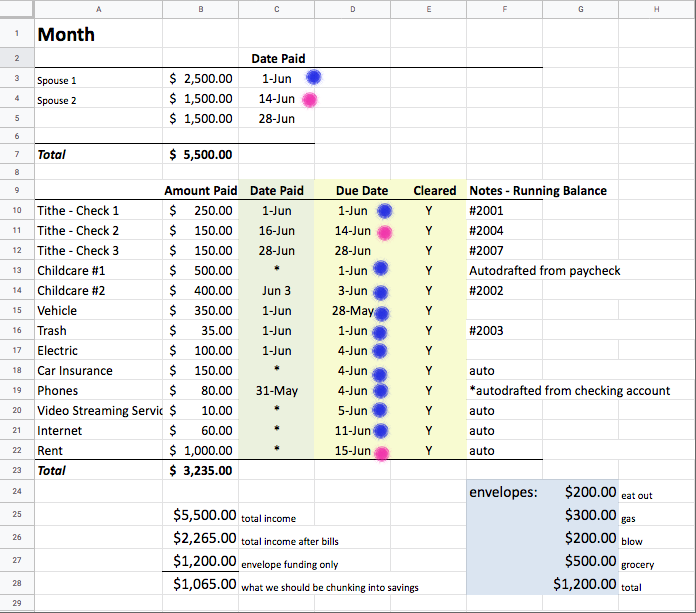

Budget Example

Now, when J and I started creating a budget, it was definitely not this short and had a heck of a lot more debt attributed to it. This is just a mock spreadsheet I created for the purposes of this blog posting to give you an idea of how our family handles the bills. The * indicates that the payment is an autodraft and I have included it in my calculations of what’s pending from the latest paycheck. When something clears, I put a Y in the Cleared column. If something hasn’t cleared, I know to still subtract that from my bank balance because that payment is coming. We spent a lot of money in overdraft fees because we kept forgetting to include pending payments when balancing the checkbook. At $35 a pop, that was an expensive lesson to learn.

Remember those lists of bills and debts that we had discussed in a previous post? Those will come into play here. At the top, I created a section for income; one of us is paid monthly and the other is biweekly. Biweekly is pretty neat because you get two months per year where there’s a third paycheck. Once you have budgeting down as a habit, that third paycheck is like a bonus for your savings account because you’re not considering that income in 10 months of your budget. Now, if you have a variable income you would probably need to create what’s sometimes referred to as a “hills and valleys” budget. Do you have a set amount that you know you will receive each check at minimum? If you do, then use that minimum as your starting point for your income notations. Build your basic budget on that minimum so that anything over that is extra which could be used to pay off debt.

Now, the bills portion contains the name or type of bill, amount you need to pay, when you paid it, when it is due, if your payment has cleared, and additional notes like check numbers or account information that you want handy. I have to mail in a check for one of our bills so I usually keep the account number and mailing address under the notes column of that particular bill so I don’t have to look it up each month. So let’s talk about how to arrange things. I have discovered that if I arrange my bills in the spreadsheet in order of their due date, I can determine which bills get paid with which checks. I also use formulas in the spreadsheet so when I adjust a number (like when an electric bill is lower than typical), the rest of my totals will reflect that new bill amount. You will see in this mock spreadsheet, that most of the bills fall around the first of the month. Spouse 1 gets paid monthly so the bulk of those bills are coming from that check. Spouse 2’s check varies as it is biweekly so it is harder to estimate what bills it will cover but if you plan on the first check about mid-month and the second at then end, then generally you could plan on a few that are consistently paid with Spouse 2’s checks.

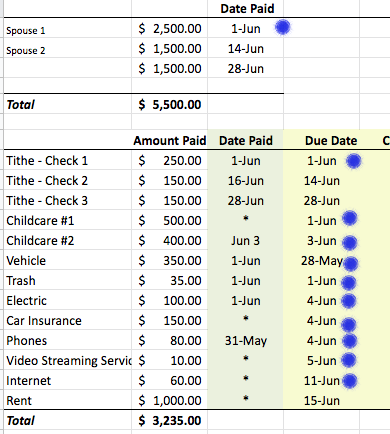

Now, you’ll notice the blue dots. This indicates what Spouse 1’s check will cover. They are paid monthly so their check is larger and can cover more expenses. If you total up what that check will cover, that is most of the bills and totals $1,935, leaving $565 left over.

When Spouse 2’s first check comes in, it will then cover the remaining bill (rent) and tithe. Spouse 2’s second check is thus not dedicated towards a debt. However, we can’t live on love and sunshine despite what songs say and we got to eat, get to work, whatnot. Here is where J and I sort of follow Dave Ramsey’s envelope system.

The Envelope System

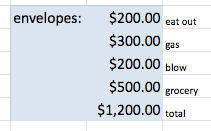

Remember when I was sitting on the floor surrounded by the papers and categorizing our expenses? I was able to get a good idea of what we were spending on the categories of fuel, groceries, and dining out. Dining out was WAY out there considering how much debt we had and how much food waste we went through. So, J and I sat down and decided on what we felt would be a fair amount to spend for eating out and worked it into our budget. The same thing went for fuel. How much did we spend to fill up the gas tanks and how often were we getting gas? That was simple math and we averaged $300 each month between us. J’s vehicle gets better gas mileage (and I tend to have a lead foot when it comes to driving) so we split that $300 between us: $120 is sufficient for his fuel needs, $180 for mine.

Groceries was a general guesstimate based on past spending habits and then we cut back to $500 per month. I started meal planning and did a lot of Crockpot cooking where I could meal prep bags to freeze on the weekends then I would thaw a bag overnight, dump in the Crockpot in the morning, and viola! Dinner that night! It’s a lot of effort to shop and prep but it’s handy to have meals ready when you get off from work because if you know you’ve got maple glazed chicken and veggies waiting for you, you won’t be as inclined to stop and grab Fast Food which is both expensive and not as healthy for you.

“Okay, so what is that line item about ‘blow’?” you might be wondering. “Blow” is just another way of saying “allowance.” That $200 is split between J and myself; we each get $100 to spend on whatever we want or save if we so choose. By having that $100 of free money, it seems easier at an emotional level to deal with budgeting everything else. I don’t feel bad about spending family funds on a stack of new used books from our local bookstore because the money is coming from my allowance. However, giving ourselves an allowance was built into our budget AFTER we paid down most of our debt. When this journey began for us, we didn’t get allowances. Every dollar we had was going to get ourselves out of that financial hole we’d created.

You might think that this concept is ridiculous and wonder why we should deprive ourselves of what we want because we worked for that money so it is technically all our money to spend on whatever we want. That is certainly one way to look at it! However, because we owed money to so many companies in the first place, the money was already spent (in a way) because we were spending it (using credit cards) before we ever earned it. It is like being an indentured servant to the credit card companies. Changing your financial situation is all about changing how you think about money. We might be denying ourselves of some things now in the short term but the benefits are going to be exponentially greater down the road.

So, we determined how much we would spend for each category: eating out ($200), fuel ($300), groceries ($500), and blow ($200). This money is actually pulled out in cash and put in envelopes that are labeled accordingly. You only spend money out of the appropriate category and when it’s gone, it’s gone… until the next month. This is a hard concept to grasp at first and there is something really impactful (at least to me) when you are running low on cash in your grocery money envelope and it’s only mid-month. I also tuck the receipts inside the corresponding envelope so I can look back at the end of the month and see what we spent where. Did I run out of grocery funds because we bought too many convenience food items? Was my fuel envelope staying full longer because of lower gas prices? Any money left in the envelopes at the end of the month gets pulled and we set that aside as money to use for Christmas gifts at the end of the year. This is kind of an added incentive to stay in or under budget. Who wouldn’t like going into their Christmas shopping with cash on hand instead of whipping out the credit card?

Tithing

I bet you noticed the three line items for tithing, one for every paycheck. This is something that is a personal choice in our family. We figure God is the one who provides us with the skills and opportunities to earn our wages so we should do our part in tithing our 10% and giving back into His kingdom. I know not everyone wants to tithe or they feel their money is better spent elsewhere. That’s understandable and totally your choice. Tithing is something I always had difficulty with because… well, I wouldn’t say I’m a controlling personality but giving away money that I earned towards something I may or may not know what it accomplishes didn’t make sense at a head level and I look at my spreadsheet and think there are seven different debt line items I could be putting that money towards instead. It didn’t make sense at all to me on one level but it seemed like even when money was tight and we were still tithing while paying stuff down, it ended up working out anyway in spite of my over-analytical brain saying that the math shouldn’t be as okay as it was. Over time, too, I have seen how that investment has paid off in our lives and in the life of our family because as we invest in our church, our church invests in us in ways that I really can see.

However, tithing is a personal choice. No judgement from me. I have just seen how it worked in our lives and know that what we give comes back to us in other ways.

Going Back to an Overview

So I have broken down the main sections and touched on how those are created. Remember when I mentioned how those blue dots were the bills paid from the Spouse #1 check and there was $565 leftover? Well, now that we’ve talked about the envelopes, we can start discussing that $565. For the purposes of this example, we’ll continue to use the figures in the sample budget. The total needed for the envelopes is $1,200 but we only have $565 left from that first check. We will need to think creatively for a moment in how we want to divide up the $565. I like even, round numbers so when I look at that $565, I need to think about what I have to accomplish until that next paycheck comes along. I will need fuel and groceries. Those are the two biggies. Eating out and allowance (or blow money) could wait until that next paycheck.

With groceries, I know we tend to shop weekly and it’s usually $100-125 per trip. When the boys were in diapers, it would be even more but fortunately diapers are no longer used in our household. It was like getting a raise! Anywho, so if Spouse 2’s first check hits April 14th, that’s two weeks worth of groceries we’ll need to get. So I know I need to allocate $250 for groceries to cover those two anticipated trips. That leaves $315. I like even numbers so I would probably put the odd $15 towards the groceries. Thus, grocery money from Spouse 1’s check would be $265 and then the remaining $300 could be the fuel envelope money and split that between the spouses. Thus, one category (fuel) is completely covered for the month and you only need $235 to finish filling up your grocery envelope, another $200 for dining out, and $200 for blow. That’s a total of $635 that will need to come from Spouse 2’s first check to finish out your envelopes for the month.

So let’s look at Spouse 2’s first paycheck of $1,500. Bills come first. In this case, rent, and tithe need to come out of that check. Those two bills only leave you with $350. You need $635 to finish out your envelopes so you’re not going to be able to completely finish out the grocery, dining out, and blow envelopes with this check. For me, my priorities would be groceries and dining out. I would go ahead and finishing filling up the grocery envelope ($235) and put the remaining $115 towards dining out. After two weeks, it would be nice to grab a meal made by someone else. We still haven’t paid the allowance envelopes yet and we need $85 to finish up the dining out envelope but that’s it (along with tithe in this example) out of the last check of the month.

Spouse 2’s second check hits on the 28th and from that $1,500, the only payment left on your spreadsheet is tithe and then you know you need to finish filling up your envelopes ($85+$200 = $285). Once you have pulled out the last of the money for dining out, allowance, and tithe, that leaves $1,215 of that last check of the month. This leftover money could either go into savings, towards paying off or paying down a debt, OR you could set aside the $1,200 and use that to prepay your envelopes for the next month (don’t touch the money until the next month though!). Then next month, all of the portions of funding you had been using from each check to piecemeal fill up your envelopes could be put into savings, thus building up for the subsequent month’s envelopes. Once you have the $1,200 for the next month’s envelopes, you can use the remaining as your snowball to paying off debts.

And just think. If this had been a three-paycheck month for Spouse 2, that check (minus tithe 😉 ) would be completely unencumbered so it could go towards either savings or debt repayment! An extra $1,350 could go a long way to knocking out a smaller credit card! OR it would be a great start to a savings account. Dave Ramsey suggests the first step in getting debt free is building a $1,000 savings so just in case something happens like a $500 emergency room copay, you have the cash to pay for it instead of using a credit card.

Get the Ball Rolling

I know this might have seemed like a lengthy post compared to most of my previous ones but this involved a lot of number crunching. I learn best by example for a lot of things and sharing this mock spreadsheet and walking through the thought process of a month of bill paying might be beneficial to others out there. This concept could be adapted to whatever your financial situation, I think, whether it’s a dual income or single income. You would also add in your credit card debts, student loan debts, whatever other debt you may have. If you have to make a payment, it goes in the spreadsheet. As you get things paid off, you’ll be able to shorten your spreadsheet and see your dollars go further.

If you have read about Dave Ramsey, you know he mentions setting aside money for sinking funds (money that is set aside for specific purposes like house maintenance, new vehicle, vehicle registration, gifts, etc. and you treat each of those sinking funds like a bill). I have tried that before but for me, it felt like I was breaking down my budget too much to grasp. Knowing that there will be expenses that fall outside of the categories we created (both planned and unplanned), we would split the money left over after paying bills and the envelopes into two purposes: debt snowball and savings. The debt snowball would be money thrown at the debt we would be targeting to get rid of. Using the spreadsheet above, we calculated having $1,215 left at the end of the month after paying bills and filling the envelopes. I would probably take that $215 and put it into savings and use the $1,000 to either completely knock out a small debt if possible or pay down the debt with the highest interest rate if the balances were all fairly equal.

Again, I’m not a financial guru or anything like that. I am just your average person who wants to share what has worked for us so maybe it could help you too. Money can be a blessing or a curse; it just depends on what we do with it. We haven’t really talked about savings as a line item in this post but we can explore that for a future Financial Friday. Have a great weekend and go green, my fellow Texans! ~ Lacie ~